India's CPI Inflation Falls Below 3% in May for First Time in Six Years, Signaling Strong Economic Stability

Inflation Dips Below 3% — A Six-Year Low

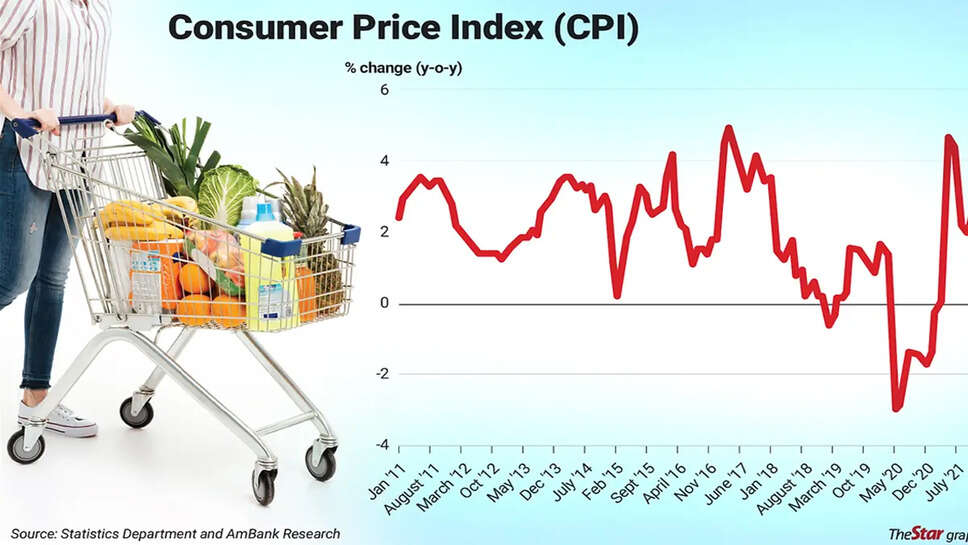

Preliminary analysis suggests India’s Consumer Price Index (CPI) inflation fell to around 2.7% in May, potentially dropping below 3% for the first time since April 2019 . This follows April’s six-year low of 3.16%, marking the longest stretch of sub-4% inflation in nearly six years — four consecutive months below RBI’s medium-term target

If confirmed, May’s print could be the lowest since April 2019’s 2.99%, signaling a sustained trend of softening prices.

🌾 What’s Driving the Decline?

1. Food Price Moderation

The biggest driver is cheaper essential food items:

-

Cereals and pulses have shown price declines year-on-year.

-

The Essential Commodities Index dipped year-on-year for the first time since early 2019 .

-

Vegetable prices slipped sharply in April; while some crops like potatoes and tomatoes saw a small monthly rise (3–10%), overall food inflation fell

2. Favorable Base Effect & Early Monsoon

Last year’s elevated May CPI provides a statistical base advantage, lowering the current inflation rate. Meanwhile, early and robust monsoon patterns enhance food supply expectations, building confidence in sustained food-price stability

3. Stable Core Inflation

Core inflation excluding food and fuel remains around 4.2%, showing some resilience in domestic demand. While slightly above April levels, economists view the uptick as temporary and manageable .

🏦 Policy Implications for the RBI

Room to Cut Interest Rates

With CPI undershooting the 4% target for several months, the central bank has cut the repo rate by 100 bps since February, including an unexpected 50 bps cut in June—bringing the rate to 5.50% .

With inflation trending around 3%, most economists expect further cuts of 25–75 bps through the year

Shift to ‘Neutral’ Policy Stance

Despite cutting rates in June, the RBI shifted from accommodative to neutral—signaling that rate cuts may pause until there’s renewed inflationary pressure

Growth vs Inflation

With inflation contained, RBI can focus more on spurring growth. The central bank targets 6.5–7% GDP growth and hopes the rate reductions support borrowing, consumption, and investment .

📊 Impact on Consumers and Households

Relief at the Pump and Grocery

Lower inflation translates to cheaper essentials—from grains to kitchen staples—giving relief to middle- and lower-income families.

Core inflation’s stability ensures this relief isn’t offset by another spending surge.

Rising Purchasing Power

With household budgets less squeezed, discretionary spending—on health, education, discretionary items—can rise, supporting economic momentum.

Expectations for Rate Cuts

Lower inflation raises expectations that loan EMIs for housing, auto, and corporate loans will ease further. That could encourage fresh borrowing by consumers and firms.

🧩 Risks to Watch

1. Tomato–Onion–Potato (TOP) Price Volatility

These staples showed some price upticks in May. If weak monsoon or supply disruptions occur, food inflation could reaccelerate

2. Oil Price and Global Shock

Global crude volatility or disruptions in energy markets could reverse inflation trends.

3. Core Inflation Pressure

Though currently steady, rising costs in health, education, transport, or housing could push core inflation and force the RBI to pause or reverse easing.

4. Statistical Base Effects

Once the low base fades, inflation could revert near 4%—timing of rate decisions will hinge on those trends and the monsoon outlook.

🔍 What to Monitor in the Coming Months

-

June CPI data—will it stay below 3%?

-

TOP Index movements—especially after monsoon progress.

-

Core inflation trajectory—whether services-driven inflation picks up.

-

Oil and commodity prices—for external risks.

-

RBI’s MPC statements—will they hint at further cuts or pause?

✅ Final Analysis

India entering six straight months of sub-4% inflation, potentially dropping below 3% in May, signals a stable disinflationary run. This gives policymakers breathing space to support growth without stoking price pressures. However, with caveats around food staples and global dynamics, cautious optimism is warranted.

For businesses, lower inflation can support investment and demand. For the general populace, it means more affordable living—fueling hopes of improved consumer sentiment.

The RBI faces a fine balancing act: sustain growth while keeping inflation anchored around 4%. If downstream pressures remain subdued and the monsoon strengthens supplies, India could enjoy one of its most favorable macroeconomic periods in years.

.jpg)